Is Stamp Paper Required for Loan Agreements in India?

You are about to sign a loan paper, maybe for a home, a car, or to help out a friend. Someone tells you it needs to be on a 'stamp paper'. You think, "Is that really needed? Can't we just print it on normal paper and sign it?"

This is a very common doubt. That stamp paper feels like just an extra step and an extra cost.

However, that stamp is not just a formality. It is the single thing that decides if your loan agreement is just a written note or a powerful document that the law will actually support.

Let's break down exactly why you cannot skip this step, what happens if you do, and how to get it right without any confusion.

What Is a Loan Agreement and Why Do You Need One?

A loan agreement is a contract you sign when you borrow money from someone or lend money to someone.

It's that piece of paper where everything about the money deal is written down. It has the names of the lender and the borrower. It clearly states the loan amount, the interest you have to pay, and the exact dates or schedule for paying it back.

This document can be short and simple, like between friends or family. Or it can be a long, detailed contract from a bank or a company with many rules. Both sides can agree to put any specific conditions they want into it. You might also hear it called a loan contract, a credit agreement, or a promissory note.

But the main point is this: it turns a verbal promise about money into a legal record. That written record is what makes the loan official and enforceable.

A contract is just paper unless it does its job. For a loan agreement, that job is to protect everyone involved.

What Is the Importance of Properly Stamped Loan Agreement India?

A loan agreement is important because it is the only legal proof you have if the other person breaks their promise.

Think about it. When you lend or borrow money, you are both making promises. The lender promises to give the money on time. The borrower promises to pay it back with interest on the agreed dates.

If you just do this on a handshake or a verbal talk, what happens if someone forgets? What if the borrower says they never took the money? What if the lender asks for more interest later? There is no proof of what was actually agreed upon.

The loan agreement fixes this.

It is the formal contract that ties both people to their word. It clearly lists the job of the lender and the job of the borrower. If one person does not do their job, like if the borrower stops paying, the other person can use this agreement in court.

Without this signed paper, you have no real way to force the other person to keep their promise. You have no legal recourse.

So, it's not just a record. It's your legal protection. The loan agreement makes the promises solid.

What Are the Key Elements of a Valid Loan Agreement?

A strong loan agreement must clearly name the people involved, state the exact money details, and set the payment plan.

A loan is mainly composed of the following key elements:

1. Parties Involved

This is about who is in the agreement. Most people think it's just the lender and borrower, but there is often a third person.

- The Lender: The person or bank giving the money.

- The Borrower: The person or company taking the money.

- The Witnesses: One or two people who sign to confirm they saw the main parties sign. They prove the agreement is real.

For each person, you must write their full name, address, contact number, and attach an ID proof like an Aadhaar card or PAN card.

2. Principal Amount & Interest

This is the core money detail.

- Principal Amount: The exact sum of money being lent.

- Rate of Interest: The percentage of extra money the borrower must pay for the loan. This rate must follow the law. If the interest is too high, the court may not support it. If it is too low or zero, it could create income tax issues.

3. Repayment Schedule

This is the plan to pay back the loan.

- Date of Commencement: The start date when the agreement is signed and the loan is given.

- Tenure: The total time until the loan must be fully paid back.

- The schedule should state the exact amounts and due dates for each payment like monthly EMIs.

4. Signatures

This is what makes the paper legally alive. The lender, the borrower, and the witnesses must all sign the document.

Getting these elements right builds a solid agreement. But even a perfectly written agreement has one more big requirement to be legally powerful.

The law asks for it to be on a special kind of paper.

Is Stamp Paper Mandatory for Loan Agreements Under Indian Law?

Yes, a stamp paper is mandatory for loan agreements in India. You can generate legally valid loan agreement stamp papers online through a secure e-stamp process, eliminating the need for physical stamp vendors.

If you want your loan agreement to be valid for any legal purpose, it must be written on the correct stamp paper. This is the law. Just getting the document notarized is not enough.

The Legal Standpoint: The Indian Stamp Act

The rule comes from a central law called The Indian Stamp Act, 1899. Think of this Act as the rulebook for a government tax that is collected in the form of stamps.

This law says that certain important papers, called "instruments", must have a government stamp on them to show a tax has been paid. A loan agreement is one such important paper. While the central government makes the main rules, the actual stamp duty rates and collection are managed by each state government. This is why the stamp duty charge can be different in Maharashtra, Karnataka, or West Bengal for the same loan amount.

What Is Stamp Duty for Loan Agreements and Why Does It Exist?

You might see stamp duty as just a small extra charge in your loan papers. But it has a very big job. It is a state government tax on legal documents like loan agreements.

This tax is what turns a simple written promise into a legally enforceable contract. When you pay stamp duty, you are buying the government's official recognition for your agreement. This makes the document strong enough to be used as evidence in any court across the country.

For the lender, it is a way to control their risk. For you, the borrower, it is a layer of protection. It ensures that if any problem comes up later, like a dispute over interest, a default, or the terms, then your agreement has the legal power to defend your rights.

Without the proper stamp however, the court may not even accept your agreement as proof until you pay the due duty and a penalty.

In short, stamp duty is not an optional fee. It is the official seal that makes your loan paperwork legally alive and enforceable.

Now that you know why it's needed, let's understand exactly what this stamp duty is and how it works.

Understanding Stamp Duty for Loan Agreements

Stamp duty is a state government tax you pay to make your loan agreement a legally strong document. With e-stamping, this stamp duty can be paid digitally and attached directly to the loan agreement.

It is not a bank fee. It is a tax, like a small charge for getting the government's official stamp on your important papers.

What is Stamp Duty on Loan Agreements?

When you buy something big, you pay GST to the government. Stamp duty is similar. It is the tax you pay to your state government for making a loan agreement legally official. This tax is charged on legal documents like loan agreements, mortgage papers, and promissory notes.

The money from this tax is state revenue. It goes to the government of the state where you sign the agreement. This is why the amount you pay can be different in Maharashtra, Karnataka, or West Bengal for the exact same loan.

How Is Stamp Duty Calculated for Different Loan Agreements?

The calculation is not the same for every loan. It mainly works in two ways:

- Flat Fee: A fixed amount you pay, no matter how big the loan is. For example, you might pay a flat ₹100 or ₹200 stamp duty for the agreement paper.

- Ad valorem Rate: This means "according to value." Here, you pay a small percentage of the loan amount. A larger loan means a higher stamp duty.

Often, for bigger loans like home loans, a hybrid structure is used. You might pay a small flat fee for the agreement paper plus a percentage on the mortgage or collateral value.

Let's look at two common examples:

- Example 1: Stamp Duty for a Personal Loan Agreement

- For a standard personal loan, many states charge a simple flat fee. You might buy a stamp paper worth ₹100 or ₹200. The duty does not change if your loan is for ₹1 lakh or ₹10 lakhs. It's a fixed cost for the agreement document.

- Example 2: Stamp Duty for a Mortgage/Housing Loan Agreement

- A home loan is more complex. You usually pay stamp duty on two main things:

- The Loan Agreement: This could be a flat fee.

- The Mortgage Deed: This is usually an ad-valorem charge. You pay a percentage (like 0.1% to 0.5%) of the total loan amount or the property's value. This is often the bigger cost. So, for a ₹50 lakh home loan, even a 0.2% duty on the mortgage deed means ₹10,000.

The key is to ask your lender for a clear breakup. Know which part of your payment is the bank's processing fee and which part is the government's stamp duty payment for property or loan documents.

Paying this duty is what gives your document legal teeth. But what happens if you skip this step or get it wrong?

The consequences are more serious than you might think.

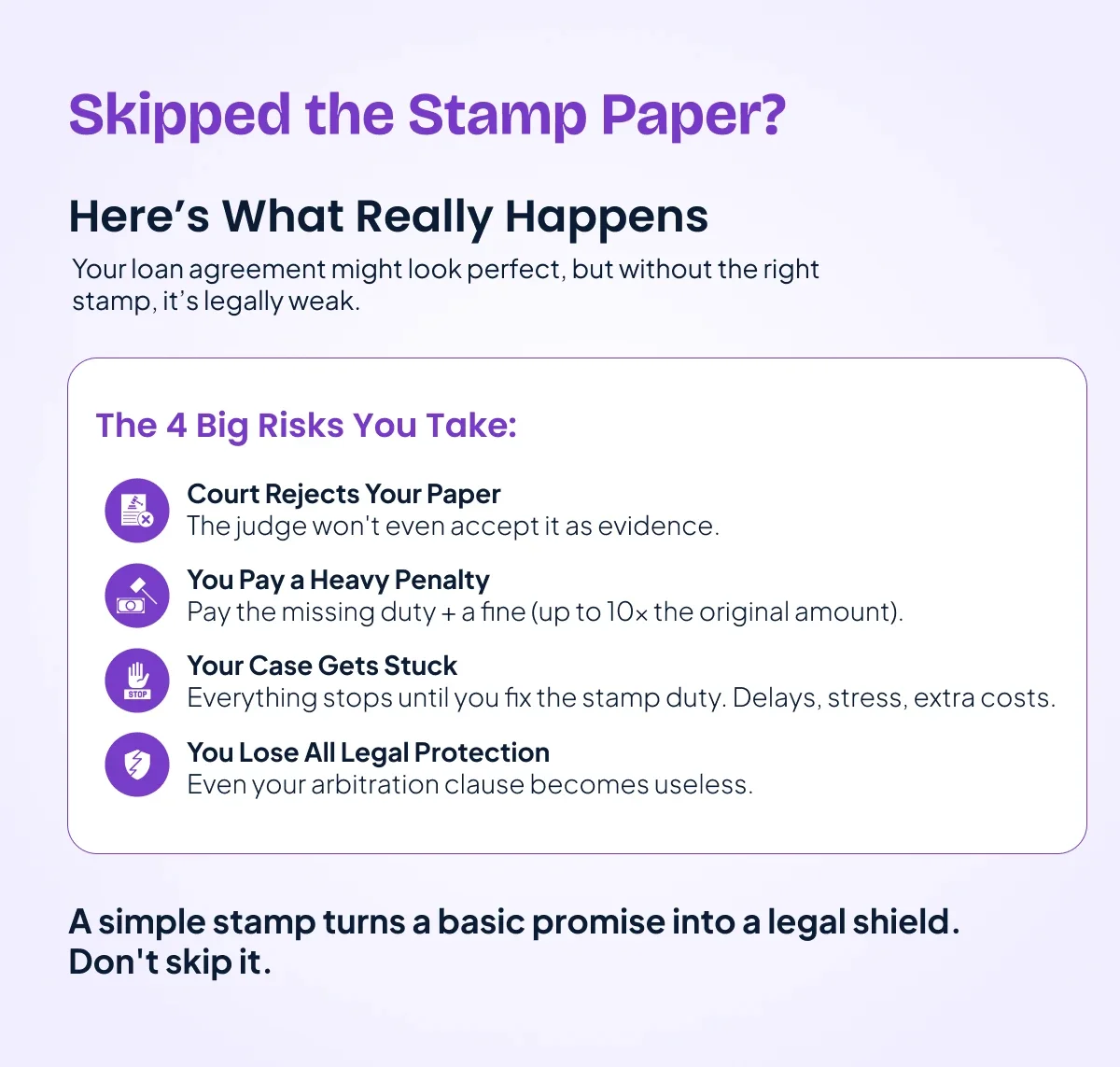

What Are the Consequences of Unstamped Loan Agreements?

An unstamped or under-stamped loan agreement is like a car without a registration. It might run, but it has no legal standing if you get into trouble.

The biggest risk is that the court will not accept your document as evidence. According to the law, a document that is not duly stamped is not admissible in court. This is one of the most common reasons digitally signed agreements fail legal scrutiny when stamp duty is ignored.

This means if you have a dispute and need to show your agreement to a judge, they will not even look at it unless you first fix the stamp duty issue.

Read: Legal validity of digitally signed agreements.

Here is what happens:

- The court rejects your paper. If you submit an unstamped agreement in court, the judge is legally required to impound it. This means they take it into legal custody and send it to the Collector of Stamps.

- You pay heavy Penalty. To get your agreement back and make it valid, you have to pay the full stamp duty you missed, plus a penalty. This penalty can be high. Up to ten times the original duty amount. It costs much more than doing it right the first time.

- Your legal case gets stuck. Your entire court case or arbitration stalls until you complete this stamp duty and penalty process. This causes long delays, extra stress, and more legal costs.

- You lose legal protection. Even important clauses inside the agreement, like an arbitration clause for solving disputes, cannot be enforced if the main agreement is not stamped. The Supreme Court has clearly said this. Your main tool for solving problems without going to court becomes useless.

In short, skipping the correct stamp duty payment for property or a loan agreement to save a small cost can make your entire contract powerless.

It turns a protective legal shield into a piece of paper that cannot defend you.

Knowing this risk makes it clear why stamping is non-negotiable. But the process and cost can change based on the kind of loan you are taking.

What Types of Loan Agreements Have Different Stamp Duty Rules?

The stamp duty you pay depends on what kind of loan agreement you are signing.

Different loan situations need different documents. Each document is treated as a separate "instrument” under the stamp law, and the duty is calculated differently.

Here are the common types:

- Promissory note: This is a simple type of loan agreement. It is basically a signed promise from the borrower to pay back a specific amount. It is often used for shorter-term or informal loans. Stamp duty is usually a small flat fee.

- Personal loan agreement: For a standard unsecured personal loan from a bank or NBFC, the main agreement often attracts a simple flat fee stamp duty in many states, like ₹100 or ₹200, regardless of the loan amount.

- Mortgage deed (for home loans): This is different from the loan agreement. When you take a home loan, you sign a mortgage deed that pledges your property as security. This deed almost always attracts an ad-valorem duty. This means you pay a percentage (like 0.1% to 0.5%) of the loan amount or the property's value, which can be a significant sum.

- Corporate or business loan agreement: These are complex contracts. Stamp duty may apply not just on the main agreement, but also on separate security documents like a hypothecation agreement for company stock or machinery. The duty can be a flat fee or a percentage, depending on the state rules and the document.

The key point is this: a single loan, like a home loan, can involve multiple documents (agreement + mortgage deed), and each needs its own stamp duty. This is why lenders give you a list of charges.

Always ask them to separate the stamp duty payment for property or loan documents from their own processing fees.

With all these rules and risks in mind, what is the final, smartest way to handle your loan agreement?

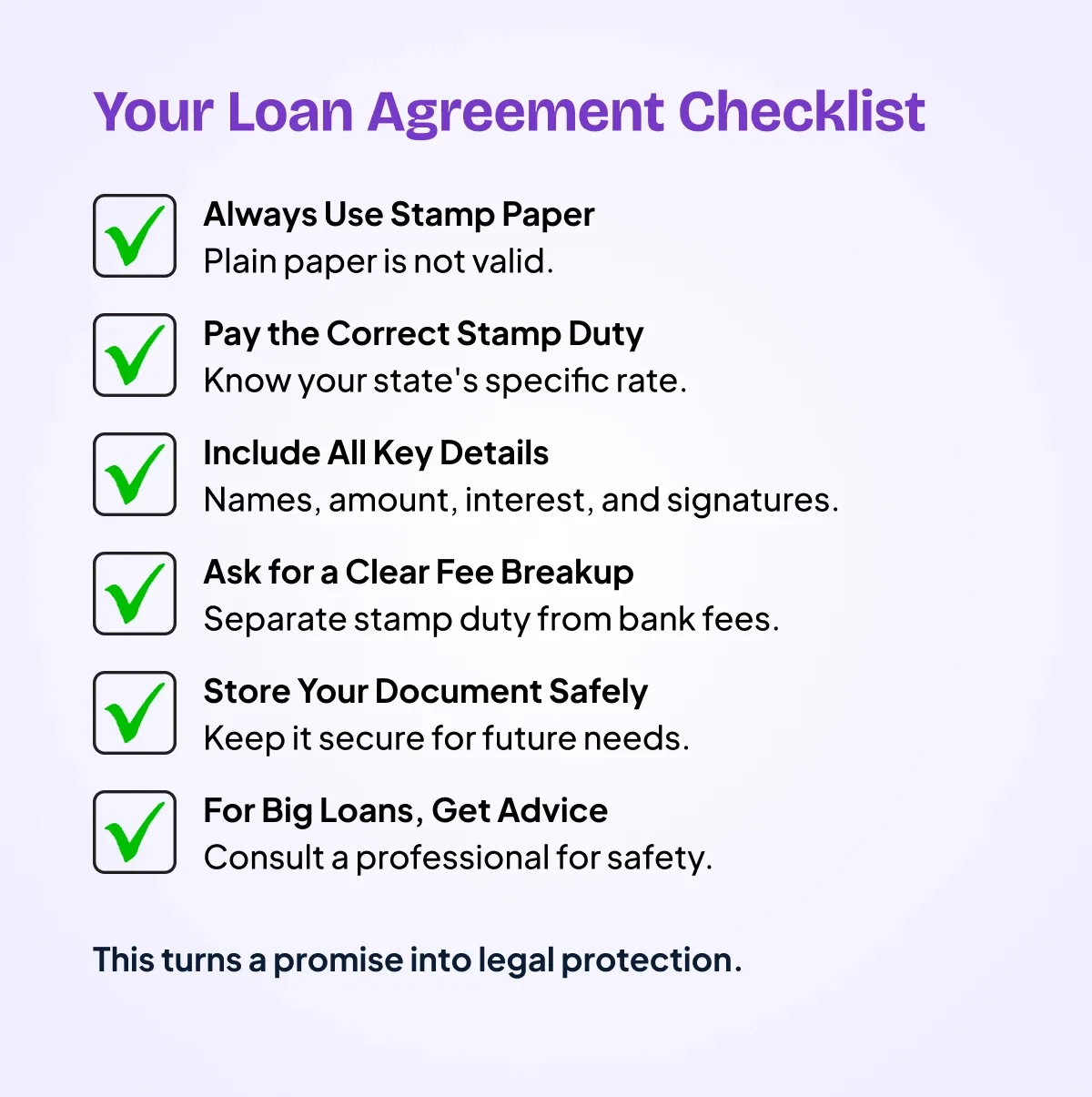

What Are Best Practices for Loan Agreement Stamp Duty?

Yes, your loan agreement must be on the correct stamp paper. There is no way around this rule if you want it to be legally safe.

Based on everything we have covered, here is the simple checklist you must follow:

- Always use stamp paper. Do not try to use plain paper or rely only on notarization. For it to be a valid legal document, it must be stamped. You can use physical non-judicial stamp paper or opt for the modern e-stamp paper online purchase system, which is safer and easier to verify.

- Pay the correct stamp duty. Find out the exact duty for your type of loan in your state. Remember, it could be a flat fee (like for personal loans) or a percentage of the amount (like for mortgage deeds). Do not underpay.

- Get the basics of the agreement right. Make sure the document clearly states the names, amount, interest rate, repayment schedule, and is signed by all parties, including witnesses.

- Ask for a fee breakup from your lender. Tell them to clearly show the stamp duty charge separately from their processing or documentation fees. You should know what you are paying to the government.

- Keep your stamped document safe forever. Store the original stamped agreement and the payment receipt (or e-stamp certificate) securely. You might need it many years later.

- For large or complex loans, talk to an expert. If you are dealing with a big home loan, a business loan, or a loan with friends and family involving a large sum, it is wise to spend a little money and consult a legal professional. They can make sure the agreement is written and stamped correctly, protecting you from huge problems later.

Following these steps turns your loan agreement from a simple promise into a powerful legal shield. It might seem like extra work and cost now, but it is the only way to make sure your money, whether you are lending or borrowing, is truly protected.

Frequently Asked Questions (FAQs)

1. Do all loans require stamp duty?

Yes, pretty much all loan agreements in India need stamp duty. This rule applies to loans from banks, online apps, or even between family and friends. It is a state government tax that makes the document legally strong. Without it, the agreement is weak in court.

2. Is stamp duty a bank fee?

No, it is not a bank charge. Stamp duty is a tax that goes to your state government. The bank just collects it from you and passes it on. It should be shown as a separate line item in your loan cost sheet, different from processing fees.

3. Can I use an e-stamp for a loan agreement?

Yes, absolutely. E-stamping is fully legal and actually a better option. You can buy an e-stamp paper online through government sites. It is safer than physical paper because it has a unique number that cannot be faked and is easy to verify online anytime.

4. What happens if I lose my stamped loan agreement?

Losing the physical paper is a big problem, but there is a fix. If you used an e-stamp, you can download the certificate again from the portal using your details. For physical stamp paper, you will need to apply to the court or collector for a certified copy, which is a long process. This is why keeping digital copies is very important.

5. Is a witness required for a stamped loan agreement?

While the stamp law itself does not demand a witness, it is a very smart and common practice. Having one or two independent witnesses sign the agreement makes it stronger. If there is ever a dispute in court, the witness can confirm that the signatures are real and the deal was agreed upon properly.

Related Topics: